Who is eligible for the deduction If the taxpayer is a resident or citizen of Russia, receives income that is taxable, and spends his money on educating his own, child, sister, brother or ward, then he has the right to apply to the tax inspection department for a refund part of the money spent. Please note! The law establishes certain rules on the form of education and on the age of persons receiving education:

- for a citizen claiming the right to a tax deduction refund, the age of the form of education can be any;

- the applicant's children, under the age of 24, full-time education;

- wards of the applicant, under the age of 18, full-time education;

- former wards of the applicant, age up to 24 years, full-time education;

- sister or brother, up to 24 years old, full-time education.

Watch the video.

Form c-09-3-1. registration of a separate division

Your organization opens a separate division. You have already decided for sure that you will have just a division, and not a branch or representative office. You also know the date of its creation. Do I need to file a report on the creation of a separate subdivision? Whether to register it at the location? What documents, when and where to submit? How to fill out the notification correctly so that you do not have to redo it? Now we will analyze everything in detail.

Message about the creation of a separate subdivision So, the first thing we have to do is to notify the tax office at the location of the organization. This obligation is established by subparagraph 3 of paragraph 2 of Article 23 of the Tax Code. The notice period is one month from the date of creation of a separate subdivision. Let's immediately see what threatens you if the deadline is missed (Article 116, Article 117 of the Tax Code, Article 15.3 of the Code of Administrative Offenses).

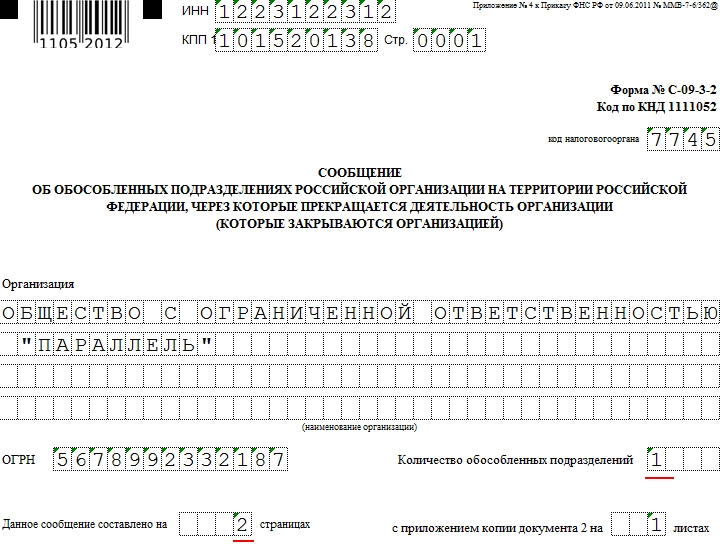

Form c-09-3-2. announcement of the closure of a separate division

How to get a 13% tax deduction for tuition: Features of the tuition deduction The Tax Code of Russia provides for the right to a refund from the budget of part of the money spent by the taxpayer when paying for tuition. The return of tax deductions occurs due to the fact that the tax base for personal income tax is reduced by the amount of expenses. And the reduction itself according to Article 219 tax code RF is a type of social tax deductions.

Remember! This type of social deductions is determined by subparagraph 2 of paragraph 1 and paragraph 2 of Article 219 of the Tax Code of the Russian Federation:

- you can make a refund for your own education and for the education of children, brothers, sisters and wards;

- the educational institution has a license without fail;

- if a refund is made for your education, then there is no restriction on age and form of education, it is limited only by the amount of money spent.

Form c-09-3-1 (sample attached)

The code from this classifier shows which municipality the originator of the application for a tax refund belongs to. READ ALSO: What to do if the tax office requires a refund of the deduction? For individuals, the code can be determined at the place of its registration. But BCC stands for budget classification code.

Each tax and action on it has its own code. In the application for a refund, which is submitted in 2018, it is necessary to indicate the following code KBK 18210102010011000110 If the application is drawn up independently, then it is not necessary to indicate OKTMO and KBK. They are required only for the form developed by the federal tax service.

Attention! Our qualified lawyers will assist you free of charge and around the clock on any issues. Learn more here.

The announcement of the closure of a separate division

Info

Always check the consistency of the data so that you do not accidentally close a working branch. In case of an error, you can submit an application to the Federal Tax Service, but there is no guarantee that it will be considered. The data on the OP must match those that were indicated in the form C-09-3-1 when opening a representative office. Remember the basic principles for filling out documents submitted to tax and other government agencies: one cell - one character.

If the checkpoint of the branch and the TIN of the authorized person are not available, it is not necessary to fill in the corresponding fields. Terms and features of submission of form C-09-3-2 Message C-09-3-2 is submitted no later than three days after the decision to close the branch was made. A copy of this decision, as well as a document proving the identity of the head (power of attorney for the representative) is attached to the document.

As a reminder, late submissions will incur a penalty for each day of delay.

Accounting for separate divisions

The specified form is used for cases of opening separate subdivisions that are not branches and representative offices. Filling out the application form for opening a separate subdivision At present, on the website of the Federal Tax Service of the Russian Federation www.nalog.ru, you can find form C-09-3-1 for 2016 and download it for free. Also, the application form can be downloaded from the link or found in the legal reference system "Consultant +".

Downloading the form from other sources does not guarantee its conformity with the officially approved form. The specified application form is submitted to the tax office only in case of opening a subdivision that is not a representative office or branch. After the form C-09-3-1 is downloaded, you can proceed to fill it out.

If the form is made using office equipment, then its filling is carried out in Courier New font with a height of 16 - 18 points.

We submit a message about the creation of a separate unit

Form of message Form No. С-09-3-1 “Notice of the Russian Federation separate subdivisions (except for branches and representative offices) of a Russian organization and on changes in previously reported information about such separate subdivisions ”(rar) Order of the Federal Tax Service of Russia dated 09.06.2011 No. ММВ-7-6 / Submission of a notice on deregistration of another separate subdivision ^ To the top of the page Taxpayers-organizations are obliged to report to the tax authority at the location of the organization about all separate subdivisions of the Russian organization on the territory of the Russian Federation through which the activity of this organization is terminated (which are closed by this organization) within three days from the date of termination of the activity of the Russian organization through another a separate subdivision (closure of another separate subdivision) (clause 3.1, clause 2, article 23 of the Tax Code of the Russian Federation).

Application form for opening a separate division

How to close a separate subdivision (branch or representative office) Closing a branch (representative office) What your company should do What the inspectors will do 2001 No. 129-FZ): - application for state registration of changes to the constituent documents in the form No. P13001; - decision to amend the constituent documents. In connection with the closure of a branch (representative office); - Changes to the founding documents. Or constituent documents in a new edition (two copies); - a message in the form No. C-09-3-2.

Suppose if an enterprise transfers (changes addresses) three OPs, then the document will increase to 4 pages. And this should be noted in the appropriate box: What matters is on whose behalf the form is submitted. If this is the director of the enterprise (code - 3), then in the column “Name of the document confirming the authority” we indicate “Passport” and in the line below - the series and number of the passport. If the applicant is a representative of the organization (code - 4), then the name is a power of attorney. These documents must be present when personally submitting to the Federal Tax Service. Checkpoints should be distinguished. The title page indicates the code of the main legal entity, in the application - divisions. Since, by law, not every company has a registration reason code, this field can be left blank. After submitting C-09-3-1, the OP can be assigned to a checkpoint, which is indicated at the bottom of the form (see attachment).

At the top, you will write the TIN and KPP of the parent organization, then the code of the tax authority where the parent organization is registered, the name of the organization in full (without abbreviations), PSRN. Next, you need to specify the number of separate divisions that you create. This is due to the fact that one message can register several separates at once.

In this case, there will be as many second sheets as the number of separates is registered - each has its own sheet. Title common to all. In our example, there will be one new division, so the message is served on 2 sheets, we indicate this. Informs - select 1 - about the creation. The reliability of the data is usually confirmed by the director, so we put the number 3 in the field, and then write his full name. For him, we write the TIN (if received), the telephone number of the organization and e-mail, if available. After filling out the message, it will be necessary to put the signature of the head and the date of filling on the title page.

A message in the form C-09-3-2 is used to notify the Federal Tax Service of the closure of a separate subdivision. This document is submitted by the head office at the place of registration of the main legal entity.

It is generally accepted that this message cancels the action of C-09-3-1, but this is a partial misconception. The difference between the forms and C-09-3-2 is that the latter covers (or rather, allows to terminate) the activities of a representative office, branch or other type of OP, which is clearly indicated in the message form. It can be submitted by both the head and the representative of the company, who has the appropriate power of attorney.

Sample filling and blank form C-09-3-2

FILES

Types of units that can be closed under C-09-3-2

On the second page of the form, you can choose by putting a number in the appropriate cell, which type of unit we are closing, there are three of them:

- branch;

- representation;

- other separate division.

Filling in the fields of form С-09-3-2

This form is machine readable, so if you are completing it by hand, please use a black ballpoint pen and enter the information in block capital letters. One cell only counts for one character, so multiple characters in one field would be an error. Messages with errors and corrections are not accepted.

Forms submitted electronically must be certified by an electronic signature.

The person with the right to sign is either the head of the company (code 3) or an authorized representative (code 4).

Page numbers are given in four-digit format, i.e. the title page is 0001 and the first page of the application is 0002.

The appendix can be given on as many pages as the offices are scheduled to close. This figure is reflected at the beginning of the document.

The number of closed OPs is equal to the number of pages in the application and 1 less than the total number of pages in the message:

Note! The checkpoint of the main legal entity is indicated on the first page, and the division to be closed is indicated in the application. Always check the consistency of the data so that you do not accidentally close a working branch. In case of an error, you can submit an application to the Federal Tax Service, but there is no guarantee that it will be considered.

The data on the OP must match those indicated in the C-09-3-1 form when the representative office was opened.

Remember the basic principles of filling out documents submitted to tax and other government agencies: one cell - one character.

If the checkpoint of the branch and the TIN of the authorized person are not available, it is not necessary to fill in the corresponding fields.

Terms and features of submission of form С-09-3-2

Message С-09-3-2 is submitted not later than three days after the decision to close the branch was made. A copy of this decision, as well as a document proving the identity of the head (power of attorney for the representative) is attached to the document. As a reminder, late submissions will incur a penalty for each day of delay.

In the event that it is not the OP that is being liquidated, but the branch, one should, among other things, attach to the message a copy of the decision to amend the statutory document, form P13002 or a notice of changes to the Charter and.

After the documents have been submitted, it will take 3-5 days to receive a notification about the closure of a separate division.

Message about the creation of a separate subdivision (С-09-3-1)

Statements

If the organization decides to create a separate division, then this should be notified to the tax in writing. For these purposes, a standard form has been developed for reporting the creation of a separate subdivision, form No. C-09-3-1 (form according to KND 1111053).

The message should be transferred to the department of the Federal Tax Service at the place of registration of the main organization. From the moment a separate subdivision is created, it is necessary to notify the tax office within a month.

You can download a sample message form C-09-3-1 from the link at the bottom of the article (excel format).

In order for a division to be considered separate, it must comply with certain rules:

- be located outside the territory of the main organization;

- have stationary equipped workplaces;

- departments must operate.

If the created unit complies with the specified rules, then it must be registered with the tax authorities. On the basis of the submitted message form C-09-3-1, the tax office shall register the unit at its location.

Other examples of statements to the tax:

- on registration of CCP form according to KND 1110021 - sample;

- on registration of IP form P21001 - sample.

How to fill out a message about the creation of a separate subdivision form C-09-3-1?

Completing the first page of the form:

- TIN, checkpoint of the organization;

- branch of the Federal Tax Service - where the organization is registered;

- name of the organization - full, as in the constituent documents;

- OGRN;

- the number of separate divisions;

- this form allows not only to report the creation of a separate subdivision, but also to make changes to it, for this you should put “1” or “2” in the “reports” field;

- traditionally, a section is filled in to indicate information about the applicant - "1" if the message is submitted by the head of the organization, "2" - if the representative. The full name of the applicant, date, signature and telephone number are filled in below. Details of the power of attorney are filled in if the applicant is an authorized representative.

Filling out the second page of the C-09-3-1 form:

- type of change - filled in if the organization wishes to report a change in data about an existing unit;

- Checkpoint - for a separate subdivision;

- department name;

- address;

- date of creation of a separate subdivision;

- code of the main type of activity according to OKVED;

- Full name of the head of the unit, as well as TIN, if available, and telephone number for communication.

The completed message form C-09-3-1 is certified by the signature of the applicant, if available, a power of attorney is attached.

Download sample message

Message on the creation of a separate subdivision 2015 form form C-09-3-1 - download.

Form C-09-3-1. Registration of a separate division. Sample fill.

How to fill out a message form No. C-09-3-1

A message about the creation of a separate subdivision, form No. C-09-3-1, is sent to the tax office in order to register this subdivision. You can download the C-09-3-1 form at the end of the article.

The message must be submitted to the tax office located at the location of the organization itself. Upon receipt of the message, the tax authority will register the newly created separate subdivisions at their location.

Separate subdivisions mean a subdivision that is separate from the organization itself and has its own equipped stationary workplaces. This unit must be registered with the tax authority at its location. For this purpose, a message form C-09-3-1 is submitted.

This form is approved by the tax authority and must be submitted to the Federal Tax Service within a month from the date of creation of a separate subdivision.

Download also: application for registration of IP R21001 - download a sample, application for an extract from the Unified State Register of Legal Entities - download a sample, application for registration of CCP form according to KND 1110021 - download.

Sample of filling out the form No. С-09-3-1

The form is very simple and will not take long to fill out.

At the top, you need to register the TIN and KPP of the organization itself, the code of the Federal Tax Service, where the message is submitted.

In the field "Organization" you need to write its name in full. Empty cells should be crossed out.

The OGRN of the organization and the number of separate divisions are written below.

The message form С-09-3-1 is filled out not only in case of creating new separate divisions, but also in case of their changes.

In the corresponding field, the number "1" or "2" must indicate what exactly the organization wants to report.

The form can be submitted by the head of the organization or his representative.

In the first case, at the bottom left, you need to put the number "3" and indicate the name of the head, his TIN, phone number, signature and date.

In the second case, similar data is filled in by a representative acting on the basis of a power of attorney to represent interests in the tax office.

The name of the power of attorney itself is written at the bottom of the C-09-3-1 form, and a copy of it is attached to the message.

On the second sheet of the document, information about separate divisions is filled in. If there are several of them, then for each you need to fill out a separate page.

Download a sample message on the creation of a separate subdivision form C-09-3-1 - link.

We submit a message about the creation of a separate unit

An organization can create a separate subdivision, the main features of which are a separate location (apart from the organization itself. At the same time, stationary jobs must be located at the location of the subdivision, the creation period of which exceeds 1 month. Another sign is the fact of doing business through it.

When creating a separate subdivision on the basis of an order, the organization should notify the tax service about this event. For this purpose, the tax authorities have developed a standard form for reporting the creation of Form C-09-3-1. We offer you to download the message form that is current for 2017 at the link at the bottom of the article.

There are certain rules for filing a message about the opening of a separate subdivision:

- form C-09-3-1 is submitted to the tax office, which is located at the location of the organization itself;

- the deadline for submitting this document is 1 month from the date of formation of the unit.

Download samples of other notifications:

- on the transition to the simplified tax system form 26.2-1 - download a sample;

- about the selected objects of taxation - a sample;

- on the use of the right to exemption from VAT - sample.

How to correctly fill out the message form С-09-3-1?

The following fields must be filled in the form:

- TIN and KPP of the organization;

- branch code of the IFTS;

- full name of the organization;

- OGRN of the organization;

- the number of existing departments (for example, 0001);

- then “1” should be indicated if it is necessary to inform about the creation of a new separate subdivision, “2” if it is necessary to make changes to the existing one;

- then the number of sheets of the message and the number of sheets of attached documents are indicated;

- when submitting a message C-09-3-1 by the head of the organization, put the number “2” in the lower left subsection of the form and indicate the name of the head, his TIN and contact phone number, if the message is submitted by a representative of the organization, then fill in the similar details of the representative, and below write down information about the document giving him the right to act on behalf of the organization (power of attorney).

On the second sheet of the C-09-3-1 form, you need to fill in the following information about the separate subdivision:

- type of change, if you want to report changes to existing departments;

- Checkpoint of a separate subdivision, if any;

- its name in full;

- the address where the unit is located;

- date of creation or modification;

- code of the type of activity of a separate subdivision;

- Full name of the head, if any, his TIN;

- telephone for communication.

The completed message form C-09-3-1 is signed by the head of the organization or its representative and transferred to the specified department of the tax service.

Order of the Federal Tax Service of June 9, 2011 N ММВ-7-6 / [email protected]"On approval of the forms and formats of messages provided for in paragraphs 2 and 3 of Article 23 of the Tax Code of the Russian Federation, as well as the procedure for filling out message forms and the procedure for submitting messages in electronic form via telecommunication channels" (with amendments and additions)

- Appendix N 1 (repealed) Appendix N 2. Form N С-09-2 "Notification of participation in Russian organizations" except for branches and representative offices) of a Russian organization and on changes to previously reported information about such separate subdivisions" Appendix N 4. Form N С-09-3-2 "Report on separate subdivisions of a Russian organization in the territory of the Russian Federation through which the organization's activities are terminated (which are closed by the organization)" Appendix No. 5 (repealed) Appendix No. 6. Format of the message on opening (closing) an account (personal account), on the emergence of the right (termination of the right) to use a corporate electronic means of payment (KESP) for electronic money transfers (lost force) Appendix No. 7. Format of the message about participation in Russian organizations in electronic form N 9. Format of a message about separate subdivisions of a Russian organization on the territory of the Russian Federation, through which the organization’s activities are terminated (which are closed by an organization) Appendix N 10. Format of a message about the reorganization or liquidation of an organization (repealed) Appendix N 11. (closing) of an account (personal account), on the emergence of the right (termination of the right) to use a corporate electronic means of payment (KESP) for electronic money transfers" (repealed) Appendix N 12. Procedure for filling out the form "Notification of participation in Russian organizations"

- Appendix N 13

- Appendix N 14

- Appendix N 16

- II. Procedure for filling out page 0001 "Notification of the establishment of separate subdivisions (with the exception of branches and representative offices) of a Russian organization in the territory of the Russian Federation and changes in previously reported information about such separate subdivisions" (clauses 3 - 12) III. The procedure for filling out page 0001 "Notification of the creation of separate subdivisions in the territory of the Russian Federation (with the exception of branches and representative offices) of a Russian organization and changes in previously reported information about such separate subdivisions" (clauses 13 - 22)

- II. Procedure for filling out page 0001 "Report on separate subdivisions of a Russian organization on the territory of the Russian Federation, through which the organization's activities are terminated (which are closed by the organization)" (clauses 3 - 11) III. The procedure for filling out the page "Information about a branch, representative office, about another separate division" (clauses 12 - 21)

- Appendix No. 1. Confirmation of the date of dispatch (no longer valid) Appendix No. 2. Format of confirmation of the date of dispatch (no longer valid) Appendix No. 3. Receipt of acceptance (no longer valid) Appendix No. 4. Format of receipt of acceptance (no longer valid) Appendix No. 5. Notification of refusal to accept (repealed) Appendix N 6. Format of a notification of refusal to accept (repealed) Appendix N 7. Notice of receipt of an electronic document (repealed) Appendix N 8. Format of a notification of receipt of an electronic document (repealed) Appendix N 9. Notification of the result of receiving the message by the tax authority in electronic form Appendix N 10. Information message about representation in relations regulated by the legislation on taxes and fees taxes and fees (lost)

Order of the Federal Tax Service of June 9, 2011 N ММВ-7-6 / [email protected]

"On approval of the forms and formats of messages provided for in paragraphs 2 and 3 of Article 23 of the Tax Code of the Russian Federation, as well as the procedure for filling out message forms and the procedure for submitting messages in electronic form via telecommunication channels"

With changes and additions from:

form N С-09-6 "Notification of participation in Russian organizations" in accordance with Appendix N 2 to this Order;

Form N С-09-3-1 "Notification on the establishment of separate subdivisions (with the exception of branches and representative offices) of a Russian organization on the territory of the Russian Federation and on changes to previously reported information about such separate subdivisions" in accordance with Appendix No. 3 to this order;

form N С-09-3-2 "Report on separate subdivisions of the Russian organization on the territory of the Russian Federation through which the organization's activities are terminated (which are closed by the organization)" in accordance with Appendix N 4 to this order;

the format of the message about participation in Russian organizations in electronic form in accordance with Appendix No. 7 to this Order;

the format of the message about the creation in the Russian Federation of separate subdivisions (with the exception of branches and representative offices) of the Russian organization and about changes in previously reported information about such separate subdivisions in electronic form in accordance with Appendix No. 8 to this order;

the format of the message about the separate subdivisions of the Russian organization on the territory of the Russian Federation, through which the organization's activities are terminated (which are closed by the organization) in electronic form in accordance with Appendix No. 9 to this order;

The procedure for filling out the form "Notice of participation in Russian organizations" in accordance with Appendix No. 12 to this Order;

The procedure for filling out the form "Notification of the creation of separate divisions in the territory of the Russian Federation (with the exception of branches and representative offices) of a Russian organization and changes in previously reported information about such separate divisions" in accordance with Appendix No. 13 to this order;

The procedure for filling out the form "Report on separate subdivisions of a Russian organization on the territory of the Russian Federation through which the organization's activities are terminated (which are closed by the organization)" in accordance with Appendix No. 14 to this order;

The procedure for the submission by organizations and individual entrepreneurs, as well as notaries engaged in private practice, and lawyers who have established law offices, of messages provided for in paragraphs 2 and 3 of Article 23 of the Tax Code of the Russian Federation, in electronic form via telecommunication channels in accordance with Appendix No. 16 to this order .

2. Recognize invalid the order of the Federal Tax Service dated April 21, 2009 N MM-7-6 / [email protected]"On Approval of the Forms for Reporting by Taxpayers of the Information Provided for by Clauses 2 and 3 of Article 23 of the Tax Code of the Russian Federation" (registered by the Ministry of Justice of the Russian Federation on May 22, 2009, registration number 13983; Rossiyskaya Gazeta, 2009, No. 99).

3. The Informatization Department (V.G. Kolesnikov), FSUE GNIVTs of the Federal Tax Service of Russia (R.V. Filimoshin) ensure the development and maintenance of software that implements the presentation of messages provided for in paragraphs 2 and 3 of Article 23 of the Tax Code of the Russian Federation in electronic form.

4. Heads of departments of the Federal Tax Service for the constituent entities of the Russian Federation to bring this order to the lower tax authorities.

5. To impose control over the execution of this order on the deputy head of the Federal Tax Service, who is in charge of accounting for legal entities and individuals, as well as foreign organizations and citizens.

Registration N 21307

The new edition sets out the forms by which information is submitted to the tax authority on the opening (closing) of an account (including a personal one), on participation in Russian and foreign organizations, on reorganization or liquidation.

They haven't changed significantly.

Thus, the e-mail of the person confirming the accuracy and completeness of the information provided, the date of the decision to liquidate (reorganize) are additionally indicated. New forms of the latter are provided: division and selection with simultaneous attachment.

Instead of form N С-09-3 "Notification of the creation (closing) of a separate subdivision of the organization on the territory of the Russian Federation" the following are introduced.

Form N С-09-3-1. It informs about the creation in our country of separate subdivisions (with the exception of branches and representative offices) of a Russian organization and about changes in previously reported information about them.

Form N C-09-3-2 is intended to notify about separate subdivisions of a Russian organization in our country through which its activities are terminated (which are closed by it).

The procedure for filling out new documents, as well as their electronic format, has been established.

The procedure for the submission of relevant messages by organizations and individual entrepreneurs, as well as private notaries and lawyers who have established their offices, has been fixed.

Order of the Federal Tax Service of June 9, 2011 N ММВ-7-6 / [email protected]"On approval of the forms and formats of messages provided for in paragraphs 2 and 3 of Article 23 of the Tax Code of the Russian Federation, as well as the procedure for filling out message forms and the procedure for submitting messages in electronic form via telecommunication channels"

Registration N 21307

This order comes into force when it is officially published.

Applications NN 1-16 to the order are published on the website of the Federal Tax Service of Russia http://www.nalog.ru/ in the section State registration and accounting of taxpayers /Accounting of taxpayers /Regulatory acts regulating the issues of accounting of taxpayers http://www.nalog.ru/ gosreg/reg_np/regnp_laws/3825932/

This document has been modified by the following documents:

Order of the Federal Tax Service dated October 19, 2018 N ММВ-7-6 / [email protected]

Order of the Federal Tax Service dated August 11, 2015 N CA-7-14 / [email protected]

The changes come into force 10 days after the day of the official publication of the said order.

Order of the Federal Tax Service of October 28, 2014 N ММВ-7-14 / [email protected]

The changes come into force 10 days after the day of the official publication of the said order.

Order of the Federal Tax Service of November 21, 2011 N ММВ-7-6 / [email protected]

The changes come into force 10 days after the day of the official publication of the said order.

To remove a unit from tax records, submit a message to the Federal Tax Service at the place of registration of the organization in the form N С-09-3-2. You need to have time to submit an application within 3 working days from the date the head of the order is issued to close the separate subdivision.

Note! We are talking here specifically about a unit that is not a branch or representative office (sub. 3.1, clause 2, article 23 of the Tax Code of the Russian Federation).

You can submit a message in the form C-09-3-2 (clause 7 of article 23 of the Tax Code of the Russian Federation):

- personally (this will be done by the head of the company or its representative by proxy);

- by mail with a valuable letter with a description of the attachment;

- for telecommunications in

The IFTS at the place of registration of the company will independently send your message to the inspection at the place of registration of the unit. After the inspectors deregister the unit, you will be sent a notification on the form No. 1-5-Accounting (clause 14 of the Letter of the Federal Tax Service dated 03.09. [email protected]).

Note! If you miss the three-day deadline for submitting a report, the IFTS can issue two fines at once. One - for a company in the amount of 200 rubles. (Clause 1, Article 126 of the Tax Code of the Russian Federation). The second - for the head in the amount of 300 to 500 rubles. (part 1 of article 15.6 of the Code of Administrative Offenses of the Russian Federation).

How to close a branch or representative office

To close a branch or representative office, submit to the Federal Tax Service Inspectorate at the place of registration of the company (paragraph 2, subparagraph 3.1, paragraph 2, article 23 of the Tax Code of the Russian Federation) the same form No. C-09-3-2. This must be done within three working days from the date of the decision to close the branch (representative office).

Form с-09-3-2: download form

Briefly, we have compiled the rules by which you need to close a separate division (branch, representative office) in the table.

How to close a separate division (branch or representative office)

Closing of a branch (representative office) |

|

|---|---|

|

What should your company do |

What will the inspectors do? |

|

Submit to the IFTS the place of registration of the head office (subparagraph 3, paragraph 2, article 23 of the Tax Code of the Russian Federation, paragraph 1, article 17 of the Law of 08.08.2001 No. 129-FZ): - decision to amend the constituent documents. In connection with the closure of a branch (representative office); - Changes to the founding documents. Or constituent documents in a new edition (two copies); - a message in the form No. C-09-3-2. Documents must be submitted within three working days after the decision to close the branch (amendments to the constituent documents) of the organization |

IFTS place of registration of the company: – sends you a notice in Form No. P50007; - sends to the Federal Tax Service Inspectorate the location of the branch (representative office) the information contained in the Unified State Register of Legal Entities about its liquidation. IFTS of Russia at the location of the branch (representative office): |

|

Closing of a separate division |

|

|

Organization actions |

Inspection actions |

|

Send a message to the IFTS at the place of registration of the company in the form No. С-09-3-2 (subclause 3, clause 2, article 23 of the Tax Code of the Russian Federation) Documents must be submitted within three working days from the date of issuance of the order to close a separate division of the organization |

The IFTS at the place of registration of the company sends information about its closure to the inspectorate at the location of the unit. IFTS at the location of the unit: |