Reliable and up-to-date information on business transactions is needed both in order to effectively manage the company and for tax accounting purposes. The business journal is one of the basic accounting documents. On its basis, statements, certificates, and summaries are compiled that are necessary for the work of any financier or accountant.

A business transaction journal is an accounting document that reflects all transactions taking place in an enterprise.

Using the business transaction log, management, together with the finance and accounting departments, can monitor the current financial situation in the company, analyze changes, and also predict future production needs.

The procedure for drawing up and a sample of filling with postings

Depending on the form in which the journal is kept (paper or electronic), the technique for maintaining it changes.

If the magazine is paper, then you need to perform a sequence of certain actions:

- First you need to open the magazine.

- Then you need to reflect the business transaction with its details (date, content, type) on a new line.

- If necessary, you can indicate the documents on the basis of which the posting was made.

- Following this, you need to reflect the amount of the transaction.

- After this, you need to indicate the debit and credit of the accounts used (debit usually indicates the obligations to the company and the amount of funds actually received, while credit indicates the company’s obligations to creditors and the amount of funds actually paid).

- And finally, you need to sign and decipher it.

What is a fire extinguisher logbook and how to fill it out correctly, you can find out

This sequence remains the same for any business transaction.

If the journal is kept in electronic form, for example, in the 1C Accounting program, then to reflect a business transaction you will need to do the following:

- Open the program with which accounting is carried out, click on the “Menu” tab, find the “Accounting” section, find the “Business Operations” section and click on the “Add” button.

- In the window that opens, you must specify the name of the transaction with all the details (date, type, amount).

- If necessary, you can indicate information in the “From” section.

- Following this, it is necessary to reflect the debits and credits of the accounts used. (In order to link a banking transaction to a transaction, you need to find the required document, right-click on it and select “Approve”, after which the document will correspond with the transaction).

- And finally, you need to save the business operation.

What is a fire safety briefing log and is it mandatory to keep it at an enterprise - read

Basically, the sequence of these actions does not change when reflecting any business transactions.

Where can I download a free example and samples of a business transactions journal?

You can download an example of filling out a business transactions journal

Committed in the course of the enterprise’s activities must be recorded in special regulations. It is called the “Journal of Business Transactions”. This document defines the algorithm for reflecting transactions in accounting and tax accounting in the 1C system.

Main tasks of accountingThe first is the generation of data about the company and its property. Moreover, the information should be as complete as possible and have a high degree of reliability. This data is necessary not only for the management of the enterprise and specialists, but also for creditors and investors.

The second important task is to provide both external and internal users of reporting with timely information. The above provision is necessary to monitor the enterprise’s compliance with current legislation.

The third task is to prevent the emergence of negative trends in the activities of an economic entity, obtain information about existing potential and reserves, and also draw up a forecast of financial results.

The Journal of Business Operations helps the specialist in all this. In addition, the implementation of the above tasks contributes to the development of competition. Currently, the accountant is helped to compile a “Journal of Business Operations” by a specially developed regulation, which bears the same name, as well as automated control, which allows you to check the actions performed by the user for compliance with the provisions of the document.

Business operations. Their types

Every operation has an impact on the enterprise. There is either a change in the sources of information about the property or its size. There are situations when both the first and second things happen at the same time. This is why the Business Transaction Log is extremely important. So, there are four main types of operations. The classification is carried out depending on how they affect the size of the passive and active parts of the balance sheet.

Type one

These operations directly affect the composition of the property of an economic entity. In other words, they affect the asset exclusively. However, it remains the same.

Type two

This type of operation is the opposite of the first. In this case, there is a change in the sources of formation of the company's property. That is, a liability. Nothing happens to the currency either.

In this case, there is a change in the size and sources of property formation. This refers to exclusively positive trends, that is, an increase. The balance sheet currency also increases, both in the active and passive parts.

Type four

The last type of operation also affects both parameters, but in the direction of reduction. The balance sheet currency is reduced by the same amount in both the passive and active parts.

Brief summary

From what is stated above, we can draw the following conclusion: “The Journal of Business Operations” is an important document that allows you to unify and systematize information about the activities of an enterprise, provides easier access to data, which is important for making management decisions.

Transcript

1 IDZ. Accounting for fixed assets and inventories. Task: 1. Fill out the journal of business transactions for the 1st quarter of the current year. 2. Register the accounts on which there were transactions. 3. Draw up a balance sheet as of March 31 of the current year. Legend: fixed assets; MPZ material and production inventories; SLSPI method of calculating depreciation based on the sum of years of useful life; MLR reducing balance method. Methodical instructions During the implementation of the first point of the task, the business transactions journal is filled out in the following form (Table 1). Table 1 Example of filling out a journal of business transactions op Date Contents of transaction Correspondence of accounts Receipt of fixed assets Amount Calculation Equipment received from suppliers D08 K / 1.18 VAT on received equipment is reflected Equipment accepted for accounting as a fixed asset Depreciation of fixed assets 4 for January 5 for February 6 for March Inventories 7 receipt of the 1st batch 8 VAT 9 receipt of the 2nd batch 10 VAT 11 payment made 12 release to production Invoices, transactions on which took place during the 1st quarter, are drawn up as follows ( table 2): 1. The account balance as of January 1 from the source data in the task is indicated as the opening balance.

2 2. The “body” of the account indicates transaction numbers and amounts according to the business transactions journal. 3. The turnover and final balance are calculated. Table 2 Example of account registration D 60 NS) K OD - OK KS At the final stage of the task, a balance sheet is filled out for account balances at the end of the period (Table 3). Table 3 Example of filling out a balance sheet Asset Name of item as of March 31 Liability as of January 1 Name of item as of March 31 as of January 1 Debt to suppliers Balance Sheet Options 1 10 Account balances as of January 1 of the current year Name of item Amount Note Fixed assets Group of homogeneous fixed assets Depreciation fixed assets Inventories of materials kg. 500 rub./kg. Inventory in work in progress Cash register Current account Debt to suppliers and contractors Debt to the bank on short-term loans Authorized capital Debt to the budget for taxes and fees Extract from the accounting documents of the enterprise

3 Method of calculating depreciation of existing fixed assets using fixed assets, years 1 linear 4 FIFO 2 linear 5 average 3 linear 6 average 4 linear 7 FIFO 5 linear 8 average 6 linear 9 FIFO 7 linear 10 average 8 linear 9 FIFO 9 linear 8 average 10 linear 7 average Inventory valuation method Operations for the reporting period: 1. A contract for the sale of part of the equipment was concluded (payment was made in the same month) Date of conclusion of the contract Initial cost of the written-off fixed asset Accumulated depreciation on the written-off fixed asset Sales price (including VAT 18%) Last day of the month depreciation of fixed assets is calculated for the current month. 3. Materials received (subject to VAT at the rate of 18%): 1st delivery, 2nd delivery Payment made in the same month. 1st delivery 2nd delivery Release into production Nat. units Price (without Nat. Price (without Date Nat. unit. VAT), unit. VAT),

4 Options Account balances as of January 1 of the current year Name of item Amount Note Fixed assets Group of homogeneous fixed assets Depreciation of fixed assets Inventories of materials pcs. 1000 rub./pcs. Inventory in work in progress Cash register Current account Debt to suppliers and contractors Debt to personnel for wages Authorized capital Retained earnings Debt of founders Extract from the accounting documents of the enterprise Method of calculating depreciation of existing fixed assets using fixed assets, years Method of assessing inventories 11 linear 10 average 12 linear 15 average 13 linear 15 FIFO 14 linear 20 average 15 MOO (K=2) 10 FIFO 16 linear 25 average 17 MOO (K=2) 15 FIFO 18 linear 10 average 19 linear 15 average 20 MOO (K=2) 20 FIFO Operations for the reporting period : equipment was received as a contribution to the authorized capital: Date of installation Estimated cost of use on the balance sheet Accepted method of calculating depreciation SLSPI MUO (K=2) SLSPI MUO (K=2) SLSPI MUO (K=2) SLSPI MUO (K=2)

5 SLSPI MUO (K=2) 2. On the last day of the month, depreciation of fixed assets for the current month is calculated. 3. Materials received (subject to VAT at the rate of 18%): 1st delivery, 2nd delivery Payment made in the same month. 1st delivery 2nd delivery Release into production Date Nat.unit Options Account balances as of January 1 of the current year Name of item Amount Note Fixed assets Group of homogeneous fixed assets Depreciation of fixed assets Inventories of raw materials l. 200 rub./l. Inventory in work in progress Cash register Current account Debt to suppliers and contractors Debt to personnel for wages Authorized capital Retained earnings Customers' debt Extract from the enterprise's accounting documents Method of calculating depreciation of existing fixed assets using fixed assets, years 21 linear 10 average 22 linear 15 FIFO Method of assessing inventories

6 23 linear 15 average 24 SLSPI (in its 3rd year of operation) 20 FIFO 25 linear 10 average 26 SLSPI (in its 4th year of operation) 25 FIFO 27 linear 15 average 28 linear 10 average 29 SLSPI (in its 5th year of operation) 15 FIFO 30 linear 20 FIFO Transactions for the reporting period: the company acquired the machine Date of putting on the balance sheet Cost of the machine (including VAT 18%) of use Accepted method of calculating depreciation MOO (K=2) SLSPI MOO (K=2) SLSPI MOO (K=2) SLSPI MUO (K=2) SLSPI MUO (K=2) MUO (K=2) 2. Depreciation of fixed assets for the current month is calculated on the last day of the month. 3. Raw materials received (subject to VAT at the rate of 18%): 1st delivery, 2nd delivery Payment made in the same month. 1st delivery 2nd delivery Release into production Date Nat.unit

ACCOUNTING: CHECK WORK Accounting test with solution. Completed on www.matburo.ru 1. Based on data on the state of the enterprise’s economic assets as of 01.08. d. compose

4. CONTROL WORK 4.1. General guidelines In the 5th semester, the student performs a test using the data from tables 1, 2, 3. Options for the test are presented in table. 2. Number

Practical lesson. Topic 3. Accounting for fixed assets Examples of problem solving This practical lesson consists of two blocks: - in block 1 a practical example of synthetic accounting of receipts is considered

TESTS IN THE DISCIPLINE "ACCOUNTING" 1. The assets of the balance sheet are grouped: a) Property of the enterprise, b) Sources of formation of property, c) Authorized capital, d) Business operations. 2. Accounting

1. ACCOUNTING THEORY 1. The enterprise has the following balances at the beginning of the reporting period: p/n Indicators Amount, thousand rubles. 1 Initial cost of fixed assets 10,500 2 Amount of accrued

1. The obligations of the organization are: debt of the director on business trips, advances transferred to suppliers and contractors, debt to the budget for VAT, debt of buyers to pay for products

Full-time education correspondence education Approximate list and content of practical and laboratory classes in the discipline “Accounting and Analysis” 1 Number of hours Name of classes Practical classes 1. Formation

Ministry of Education and Science of the Russian Federation Federal State Budgetary Educational Institution of Higher Education Ural State Forestry University Institute of Economics and Management Assignments for practical classes in the discipline “Accounting and Analysis” Direction:

2 Contents 1. Account balances as of January 1, 200...3 2. Balance sheet as of January 1, 200...4 3. Journal of business transactions for January...5 4. Calculation of the impact of business transactions on currency

Homework for the discipline “Accounting and auditing basics” (exercises, tasks and tests, guidelines) Balance sheet and profit and loss account (topic 2) Assignment 1 (“scattered

Minsk University of Management TASKS FOR INDEPENDENT WORK FOR CORRESPONDENCE STUDENTS in the discipline “Theoretical Foundations of Accounting and Analysis” in specialty 25 01 08 03 “Accounting”

Filling out the lines of the balance sheet The form of the balance sheet is given in Appendix No. 1 to the order of the Ministry of Finance of Russia dated July 2, 2010 N 66n (as amended by the order of the Ministry of Finance of Russia dated October 5, 2011 N 124n) Indicators

Novosibirsk State Technical University Faculty of Energy Department of Production Management and Energy Economics ACCOUNTING AND ANALYSIS Guidelines for completing the test

1) Accounting is carried out within the framework of - the state - a separate region - ministries and departments - a separate organization - a public organization 2) Accounting is an orderly system

ACCOUNTING. SOLUTION OF A END-TO-END PROBLEM 1. Open synthetic accounts and record the balances at the beginning of the month on them 2. Draw up a journal of business transactions for the month. Make the necessary calculations

CHAPTER 2 OTHER BALANCE ITEMS (ASSET) 2.1. Current assets (Asset) 2.1.1. Inventories (Asset) 2.1.1.1. Raw materials, materials and other valuables 2.1.1.2. Animals for growing and fattening 2.1.1.3. Costs in work in progress

Option 5 INITIAL DATA Table 1 Availability of property and liabilities of the organization at the beginning of the reporting period p/n Name of property (liabilities) thousand rubles. 1 Cash in the current account in

Problem solving: Accounting TASK. Based on the data to complete the task: 1. Prepare and fill out a journal for recording business transactions. 2. Open charts of accounts and reflect business transactions in them

Cross-cutting task 1. Fill out the business transactions journal and perform the necessary calculations. 2. Record account balances based on account balances, reflect business transactions for

ASSESSMENT FUND FOR INTERMEDIATE CERTIFICATION OF STUDENTS IN DISCIPLINE (MODULE) 1. Department General information 2. Direction of training 3. Discipline (module) 4. Number of stages of formation

Accounting Familiarization Test Page. 2 of 11 INSTRUCTIONS This test is for informational purposes only. With it you can prepare for the official testing, which will be

BALANCE SHEET Lecture 5. Changes in the balance sheet under the influence of business transactions Methodological recommendations for studying the topic Purpose: to analyze the types of transactions that affect changes in the balance sheet. Study questions:

Ministry of Education of the Republic of Belarus Educational Institution “POLOTSK STATE UNIVERSITY” Materials for independent practical training in the discipline “Theoretical Foundations of Accounting and Analysis”.

0710005 p. 1 Explanations to the balance sheet and profit and loss statement thousand rubles. 1. Intangible assets and expenses for research, development and technological R&D work

MINISTRY OF EDUCATION OF THE REPUBLIC OF BELARUS Educational Institution “Gomel State University named after. F.Skorina Department of Accounting, Control and Analysis of Economic Activities Assignments

DEPARTMENT OF EDUCATION, SCIENCE AND YOUTH POLICY OF THE VORONEZH REGION GBPOU VO “VORONEZH STATE INDUSTRIAL AND ECONOMIC COLLEGE” WORKBOOK FOR PRACTICAL WORK on MDK 04.01. Technology

TASK 14 Based on the grouping of economic resources according to the conditions of tasks 8, 9, 10, 11, 12, compile balance sheets of organizations. TASK 15 Indicate the type of change that will occur

CHECK WORK in the discipline “Accounting” OPTION 7 Assignment: 1. Make accounting entries for business transactions for October 200X and determine the type of each transaction. 2. Open

PRACTICAL PART OF THE COURSE WORK The practical part of the work is carried out on an individual basis. The individuality of the option is also ensured by adding to the work elements of accounting on the topic of theoretical

Home» Reports» Quarterly reports of Joint Stock Companies» Quarterly report Reasons for refusal (To be completed by moderator): Type: * Quarterly report Date of publication: April 25, 2016 16:04 Table of item names

MINISTRY OF EDUCATION AND SCIENCE OF THE RF Volgograd State Technical University METHODICAL INSTRUCTIONS for writing a test for part-time and part-time shortened forms of study Volgograd - 2013

Balance sheet as of December 31, 2012 Codes Form according to OKUD Date (day, month, year) 31 0710001 12 2012 Organization NP "Union of Managers and Anti-Crisis Managers" according to OKPO 59766335 Identification

Tests for passing the state exam in the direction 080100.62 "Economics" (POP "Accounting, Analysis and Audit") in the discipline "Accounting" Topic 1. Accounting in the management system

ASSET Balance sheet as of December 31, 2009 Indicator code At the beginning At the end of the reporting period I. Non-current assets Fixed assets 120 46263 54264 Construction in progress 130 1026 436 Total for section

SIBERIAN STATE GEODETIC ACADEMY Institute of Geodesy and Management Department of Economics and Management V.A. Shcherbakov Guidelines for completing coursework on the topic: “Compilation

Case assignment Case assignments are performed according to options in accordance with the first letter of the last name. Option 1 - for students (last names SA to K) Option 2 - for students (last names SL to P) Option 3 - for students

Contents Introduction...9 LESSON ONE...11 Chapter 1. GENERAL INFORMATION ABOUT THE PROGRAM "1C: ACCOUNTING 8"...13 Creation of an educational information base...13 Modes of working with the program...19 Basic terms and concepts

CALCULATION OF THE AMOUNT OF OWN FUNDS as of 02/28/2015 Limited Liability Company Financial Company "Business Initiative" COST OF ASSETS Name of indicator Code Cost Coefficient Cost,

The procedure for filling out the Accounting Title of articles I. Non-current assets Intangible assets 1110 Results of research and development Intangible exploration assets Tangible exploration assets 1120

QUARTERLY REPORT OF THE ISSUER FOR THE RESULTS OF THE FIRST QUARTER 2016 1 NAME OF THE ISSUER: Full: Abbreviated: Name of stock ticker: "O"zog"irsanoatloyiha Instituti" aksiyadorlik jamiyati "O"zog"irsanoatloyiha"

QUARTERLY REPORT OF THE ISSUER ON THE RESULTS OF THE THIRD QUARTER 2016 1 NAME OF THE ISSUER: Full: Abbreviated: Name of stock ticker: "O"zog"irsanoatloyiha Instituti" aksiyadorlik jamiyati "O"zog"irsanoatloyiha"

Chistov D.V., Kharitonov S.A. Business operations in “1Accounting 8” (revision 2.0). Tasks, solutions, results. Tutorial. 3rd edition, - M.: “1C-Publishing”, 2010. -460 sheets. Contents Introduction

LECTURE 6. DOUBLE ENTRY OF OPERATIONS ON ACCOUNTS. CORRESPONDENCES. ACCOUNTING ENTRY Methodological recommendations for studying the topic Purpose: studying the concept of an account, its role in the formation of accounting records

COMMITTEE FOR SCIENCE AND HIGHER SCHOOL St. Petersburg State Budgetary Educational Institution of Secondary Vocational Education "Industrial and Economic College" Correspondence Department Specialty

Scheme of accounting records for accounting of inventories () using account 10 “Materials” APPENDIX A Accounts 60, 71, 76, 23 Account 10.1 “Accounting cost” Account 20, 23, 29 by cost

Ministry of Education and Science of the Russian Federation Federal State Budgetary Educational Institution of Higher Professional Education "SIBERIAN STATE GEODETIC ACADEMY"

1050!2013! INN 7107099683 Checkpoint 710701001Page. 1 Accounting statements Form according to KND 0710099 Adjustment number 0 Reporting period (code) 3 4 Reporting year 2 0 1 1 OPEN E A C T I O N E R N O E O

Structure: 1. General instructions. Requirements for completing the test 2. The sequence of completing the test on a PC: 2.1. Entering data about the organization 2.2. Filling out reference books 2.3. Enter

MINISTRY OF EDUCAMENT AND SCIENCE OF THE RUSSIAN Votkinsk branch of the federal state budgetary educational institution of higher professional education “Izhevsk State Technical University named after M.T.

Organization Balance sheet as of December 31, 2011 OKUD Form Date (day, month, year) Limited Liability Company "Zhilkomservis N1 nq o k p o Admiralteysky District" Identification

International and national accounting principles and standards. The concept of accounting, its functions and tasks. Accounting policy of the enterprise. Types of economic accounting at an enterprise Accounting

There is a relationship between synthetic and analytical accounts, which is expressed as follows: - the beginning and ending balances of a given synthetic account must be equal to the sum of the balances at the beginning

Explanations to the balance sheet and profit and loss statement (thousand rubles) 1. Intangible assets and expenses for research, development and technological work (R&D) 1.1. Availability

ASSET BALANCE SHEET as of December 31, 2011 Code As of December 31, 2011 As of December 31, 2010 I. NON-CURRENT ASSETS - - - Intangible assets 1110 - - - 11101 - - - Intangible assets in the organization

Problem solving: Accounting. End-to-end task Based on business transactions, open synthetic accounting accounts and record the amounts of initial balances in them. After registering each transaction in

FEDERAL EDUCATION AGENCY OF THE RF ALTAI STATE UNIVERSITY FACULTY OF ECONOMICS DEPARTMENT OF ACCOUNTING, AUDIT AND ANALYSIS ACCOUNTING Assignments for the test Barnaul

FEATURES OF PREPARATION OF THE ANNUAL BALANCE SHEET IN LLC “SLAVYAN BUSINESS” OF THE CITY OF OMSK A.A. Ayupova, D.A. Yanina Scientific supervisor M.A. Rabkanova, Ph.D., Associate Professor, Department of Economics, Accounting

Balance is a method of economic grouping in the monetary valuation of an organization's economic assets by composition and location, as well as by the sources of their formation on a certain date. Balance represents

PRACTICUM FOR LECTURES ON THE DISCIPLINE “ACCOUNTING” Task 1 According to the constituent documents, the size of the authorized capital of the organization is 100,000 rubles. Debt on deposits is repaid by the founders

1050!2013! Gearbox 503401001Page. 1 Accounting statements Form according to KND 0710099 Adjustment number 0 Reporting period (code) 3 4 Reporting year 2 0 1 1 GENERAL SOCIETY LIMITED ANSWER

TASK 20 Prepare accounting entries for business transactions given in TASK 15. TASK 21 Based on the data to complete the task: 1) draw up a balance sheet for Berezka LLC as of January 1

4 0 1 2 0 1 0 0 1 Page 0 0 1 Form according to KND 0710099 Accounting (financial) statements Adjustment number 0 - - Reporting period (code) 3 4 Reporting year 2 0 1 6 JSC "MOS MEDYN A GRO P R O

1050!2013! Gearbox 722401001Page. 1 Accounting statements KND form 0710099 Adjustment number 0 Reporting period (code) 3 4 Reporting year 2 0 1 1 CLOSED EQUITY

Balance sheet as of December 31, 2015 Codes Form according to OKUD Date (day, month, year) 31 0710001 12 2015 Organization Open Joint Stock Company "Vodokanal" according to OKPO 11776137 Identification number

MINISTRY OF EDUCATION AND SCIENCE OF THE RUSSIAN FEDERATION FEDERAL STATE BUDGET EDUCATIONAL INSTITUTION OF HIGHER EDUCATION “RUSSIAN ECONOMIC UNIVERSITY NAMED AFTER G.V. PLEKHANOV" IVANOVSKY

"O"ztemiryo"lyo"lovchi" aksiyadorlik jamiyati. Location: Tashkent, Mirabad district, Turkiston street, building 7

QUARTERLY REPORT OF THE ISSUER FOR THE RESULTS OF THE FIRST QUARTER 2017 1 NAME OF THE ISSUER: Full: Abbreviated: Name of stock ticker: "O"ztemiryo"lyo"lovchi" aksiyadorlik jamiyati "O"ztemiryo"lyo"lovchi"

Each business transaction, be it receipt at the cash desk, purchase of equipment or write-off of fuel and lubricants, must be confirmed with a primary document and accepted for accounting. The primary registration should be made at the time of the operation or immediately after its completion. And to systematize information, it is customary to use special accounting registers - business transaction journals.

Journal-order form of accounting

The form of accounting in which all data on business transactions is taken into account and systematized in journals for recording business transactions is called journal-order.

The basic principles are:

- Entries are made exclusively on credit accounts, indicating correspondence on debit.

- Synthetic and analytical accounting records are combined in a single accounting system.

- Data is reflected in accounting documents in the context of indicators necessary for control and reporting.

- You can apply combined journals to related accounts.

- You can create them monthly.

It is not necessary to use this form of accounting. An organization can keep records using a memorial order form, which is based on drawing up memorial orders for each business transaction. This type has a number of disadvantages: a significant lag between analytical accounting and synthetic accounting, as well as increased labor intensity: you have to duplicate records several times.

Magazine forms

For public sector employees, the Ministry of Finance developed and recommended unified forms (Orders No. 123n dated September 23, 2005 and No. 25N dated February 10, 2006). But it is not necessary to use them (No. 402-FZ dated December 6, 2011). The organization has the right to independently develop and approve forms for accounting journals. But for this they should be approved by a separate order of the manager or in the form of an appendix to the accounting policy.

OKUD journal form 0504071

List of current journals

State employees use these types.

Non-profit organizations use others.

|

Name of journal-order |

|

|---|---|

|

Cash flow at the institution's cash desk |

|

|

Current accounts |

|

|

Special bank accounts |

|

|

Payments for loans and borrowings (short-term and long-term) |

|

|

Settlements with suppliers and contractors |

|

|

Calculations with accountable persons |

|

|

Calculations for taxes and fees, intra-business transactions, calculations for advances |

|

|

Primary production |

|

|

Accounting for finished products (goods, works or services) |

|

|

Accounting for target financing |

|

|

Fixed assets and depreciation |

|

|

Retained earnings (uncovered loss) |

|

|

Investment in non-current assets |

Features of the formation of accounting registers

Law No. 402-FZ establishes mandatory requirements for accounting documentation. Regardless of what type of form was chosen by the organization: unified or developed independently.

Mandatory register details:

- The name of the document and its form.

- Full name of the institution.

- Start date and end date of journal entries. The period for which it was formed.

- Type of grouping of accounting objects (chronological or systematic grouping).

- Indication of the unit of measurement of accounting objects, or the monetary value of the measurement.

- Indication of officials responsible for maintaining the register.

- Signatures of responsible persons.

Registration logs are compiled on paper or electronically. For the latter, you will need an electronic signature to certify the document. Without a signature (electronic or handwritten), the journal order is considered invalid.

Corrections are permitted. They can only be entered by the person responsible for maintaining the journal. Next to it, you should indicate the date and certify the correctional entry with a signature, with a description of the position and full name of the person responsible.

Filling rules

Each magazine has its own filling requirements. Let's take a closer look at the basic filling rules.

Journal of registration of incoming and outgoing cash orders (JO No. 1)

We make entries based on the cashier’s report, confirmed by relevant documents ( and ) at the end of the working day. If movements at the cash register are insignificant, it is allowed to make entries in the register 3-5 days in advance, according to several reports at the same time. Then in the “Date” field we indicate the period for which we are making records. For example, 3-6 or 20-23.

Magazine order 2

Entries are made on the basis of bank statements and other supporting documents (checks, personal account statements). It is allowed to make one entry on several bank statements. In this case, in the “date” field, be sure to indicate the start and end date of the statements.

Magazine order 6

We fill out the register based on documents confirming settlements with suppliers and contractors. Merging records is not allowed. The final balances of the previous period are transferred to the next register, in the “Balance at the beginning of the month” field.

Magazine order 7

We register settlements with accountable persons. We make separate entries for each advance report. Concatenation or grouping of rows is not allowed.

Magazine warrant 13

We make records of expenses for our own production, in the context of each business transaction (depreciation, wages of production personnel, materials, deferred expenses, etc.).

When using automated accounting programs, data in order journals is filled in automatically. Moreover, records are generated for each business transaction separately.

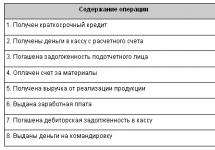

2.2 Journal of business transactions

table 2

| No. | Contents of operation | Debit | Credit | Sum |

| 1 | Raw materials and materials received from suppliers: a) purchase price (excluding VAT) | |||

| 2 | Raw materials and materials transferred: a) to main production c) for general economic needs | |||

| 3 | Accrued salary: | |||

| 4 | A single social tax has been charged in accordance with the established tariff of 26% | |||

| 4.1 | Social Insurance Fund (3.2%): a) workers of the main production b) workers engaged in maintenance and repair of equipment c) general production personnel d) enterprise management personnel | |||

| 4.2 | Federal budget (14%): a) workers of the main production b) workers engaged in maintenance and repair of equipment c) general production personnel d) enterprise management personnel | |||

| 4.3 | Contributions to the pension fund (6%): a) workers of the main production b) workers engaged in maintenance and repair of equipment c) general production personnel d) enterprise management personnel | |||

| 4.4 | Contributions to the compulsory health insurance fund (2.8): a) workers of the main production b) workers engaged in maintenance and repair of equipment c) general production personnel d) enterprise management personnel | |||

| 5 | Fuel released to main production | 20 | 10,3 | 44 000 |

| 6 | A short-term bank loan was received and credited to the current account | 51 | 66 | 20 000 |

| 7 | Cash received from the current account to the cash desk (for issuing wages) | 50 | 51 | 144 800 |

| 8 | Personal income tax withheld from wages | 70 | 68 | 14 800 |

| 9 | Wages were issued to the company's employees from the cash register | 70 | 50 | 108 400 |

| 10 | Issued from the cash register for travel and business expenses | 71 | 50 | 440 |

| 11 | Unpaid wages deposited on time | 70 | 76/4 | 36 400 |

| 12 | Cash returned from the cash register to the current account | 51 | 50 | 36 400 |

| 13 | Spent by accountable persons for the needs of main production | 20 | 71 | 4 100 |

| 14 | Depreciation calculated: a) fixed assets for general production purposes; b) fixed assets for general economic purposes | |||

| 15 | Received to the bank account: a) from debtors; b) from buyers and customers | |||

| 16 | Are written off at the end of the month to the costs of main production: a) general business expenses; b) general business expenses | |||

| 17 | Transferred from the current account to pay off the debt: a) to a bank for a loan; b) suppliers; c) the social insurance fund; d) pension fund; e) compulsory medical insurance fund; f) budget; g) creditors | |||

| 18 | Unused materials were returned from the main production workshops | 10 | 20 | 3 500 |

| 19 | Finished products are released from production (work in progress at the end of the month is 100,000 rubles) | 43 | 20 | 350 000 |

| 20 | Payment documents for sold products were presented to customers (including VAT RUB 38,430) | 62 | 90 | 251 930 |

| 21 | VAT accrued to the budget on products sold | 90 | 68 | 38 430 |

| 22 | The actual production cost of goods sold is written off | 90 | 43 | 120 000 |

| 23 | The invoice of the transport organization for the delivery of finished products has been accepted for payment: a) cost of the service; | |||

| 24 | The invoice of the transport organization for the delivery of finished products has been paid | 60 | 51 | 24 190 |

| 25 | Selling expenses related to products sold are written off | 90 | 44 | 20 500 |

| 26 | The financial result from the sale of products is revealed | 90 | 99 | 73 000 |

| Total | 1 704 858 |

2.4 Balance sheet

Table 3

| No. account | Account name | Initial balance | Monthly turnover | Final balance |

|||

| 01 | Fixed assets | 804000 | - | - | - | 804000 | |

| 02 | Depreciation of fixed assets | - | 111000 | - | 17240 | 128240 | |

| 10 | Raw materials, materials and fuel | 400000 | - | 31500 | 360000 | 71500 | - |

| 19 | Value added tax on purchased assets | - | - | 8730 | - | 8730 | - |

| 20 | Primary production | 250000 | - | 524476 | 353500 | 420976 | - |

| 25 | General production expenses | - | - | 89438 | 89438 | - | - |

| 26 | General running costs | - | 70566 | 70566 | - | - | |

| 43 | Finished products | 78500 | - | 350000 | 120000 | 308500 | - |

| 44 | Selling expenses | - | - | 20500 | 20500 | - | - |

| 50 | Cash register | 510 | - | 144800 | 145240 | 70 | - |

| 51 | Current accounts | 188000 | - | 185400 | 262770 | 110630 | - |

| 60 | Settlements with suppliers and contractors | - | 23000 | 52190 | 57230 | - | 28040 |

| 62 | Settlements with buyers and customers | 36030 | - | 251930 | 125500 | 162460 | - |

| 66 | Calculations for short-term loans and borrowings | - | 20000 | 14200 | 20000 | - | 25800 |

| 68 | Calculations for taxes and fees | - | 16100 | 13200 | 53230 | - | 56130 |

| 69 | Social insurance calculations | - | 17440 | 16380 | 29536 | - | 30596 |

| 70 | Payments to personnel regarding wages | - | 49000 | 159600 | 113600 | - | 3000 |

| 71 | Calculations with accountable persons | - | - | 440 | 4100 | - | 3660 |

| 76 | Settlements with various debtors and creditors | 3800 | 27100 | 22000 | 3500 | 300 | 5100 |

| 76/4 | Calculations on deposited amounts | - | - | - | 36400 | - | 36400 |

| 80 | Authorized capital | - | 1446000 | - | - | - | 1446000 |

| 83 | Extra capital | - | 20300 | - | - | - | 20300 |

| 84 | retained earnings | - | 17000 | - | - | - | 17000 |

| 90 | Sales | - | - | 251930 | 251930 | - | - |

| 96 | Reserves for future expenses | - | 13900 | - | - | - | 13900 |

| 99 | Profit and loss | - | - | - | 73000 | - | 73000 |

| Total | 1760840 | 1760840 | 2207280 | 2207280 | 1887166 | 1887166 | |

2.5 Chess sheet

Table 52.6 Balance at the beginning of January

| ASSETS | Sum |

| 1 | 2 |

| I. NON-CURRENT ASSETS | |

| 1.Fixed assets | 804 000 |

| TOTAL for section I | 804 000 |

| II. CURRENT ASSETS | |

| 400 000 | |

| 250 000 | |

| 78 500 | |

| 4. Cash desk | 510 |

| 5. Current account | 188 000 |

| 36030 | |

| 3800 | |

| TOTAL for section II | 956 840 |

| BALANCE | 1 760 840 |

| PASSIVE | Sum |

| 1 | 2 |

| III. CAPITAL AND RESERVES | |

| 2. Additional capital | 20 300 |

| 3. Retained earnings | 17 000 |

| 111 000 | |

| TOTAL for section III | 1 483 300 |

| TOTAL for section IV | |

| | 20 000 |

| 23 000 | |

| 49 000 | |

| 17 440 | |

| 16 100 | |

| 27 100 | |

| 13 900 | |

| TOTAL for Section V | 166 540 |

| BALANCE | 1 760 840 |

| ASSETS | Sum |

| 1 | 2 |

| I. NON-CURRENT ASSETS | |

| 1.Fixed assets | 804 000 |

| TOTAL for section I | 804 000 |

| II. CURRENT ASSETS | |

| 1. Basic materials (including raw materials and fuel) | 71 500 |

| 2. Work in progress | 420 976 |

| 3. Finished products and goods for resale | 308 500 |

| 4. Cash desk | 70 |

| 5. Current account | 110 630 |

| 6. Settlements with buyers and customers | 162 460 |

| 7. Settlements with various debtors and creditors (deb) | 300 |

| 8. VAT on purchased assets | 8 730 |

| TOTAL for section II | 1 083 166 |

| BALANCE | 1 887 166 |

| PASSIVE | Sum |

| 1 | 2 |

| III. CAPITAL AND RESERVES | 1 446 000 |

| 2. Additional capital | 20 300 |

| 3. Retained earnings | 17 000 |

| 4. Depreciation of fixed assets | 128 240 |

| TOTAL for section III | 1 611 540 |

| IV. LONG TERM DUTIES | |

| TOTAL for section IV | |

| V. SHORT-TERM LIABILITIES | 25 800 |

| 2. Accounts payable (including suppliers and contractors) | 28 040 |

| 3. Workers' salary arrears | 3 000 |

| 4. Debt to state extra-budgetary funds | 30 596 |

| 5. Debt on taxes and fees | 56 130 |

| 6. Other creditors (71, 76/4, 76 credit) | 5 100 |

| 7. Reserves for future expenses (96) | 13 900 |

| 8. Profits and losses | 73 000 |

| 9. Settlements on deposited amounts | 36 400 |

| 10. Settlements with accountable persons | 3 660 |

| TOTAL for Section V | 275 626 |

| BALANCE | 1 887 166 |

Conclusion

Thus, accounting registers, having arisen in the ancient world and having undergone many changes both in appearance and form, and in methods of recording information, have reached the present day.

As already indicated, numerous accounting registers are currently used in accounting. With the development of accounting automation, registers in the form of machine diagrams are becoming increasingly common. However, it must be indicated that when using computer media, the enterprise is obliged, at its own expense, to make copies of these registers on paper for other users. With the development of video technology, registers in the form of videograms begin to be introduced into accounting. It is possible that as technology develops, we will encounter more and more new forms of accounting registers.

However, regardless of the nature of the registration of accounting records, the general rule remains compliance with the rule of equality of the total of debit and credit turnovers, the so-called “Mendes rule” - the golden rule of accounting.

Books, cards, order journals, statements, and separate sheets are used for accounting in various combinations. Such a set of accounting registers that predetermine the connection between synthetic and analytical accounting, the methodology and technique for registering business transactions, the technology and organization of the accounting process determines the form of accounting.

Various options for accounting registers used in the enterprise will be presented below when performing a practical task. In particular, such as synthetic and analytical accounting cards, a journal of business transactions, etc.

In the second part, according to its version of the task, synthetic accounting accounts are opened and balances at the end of the month are recorded. According to the business transactions journal, correspondence accounts were compiled. The amounts of business transactions are recorded in synthetic accounting accounts. The turnover was calculated in the accounts and displayed at the end of the month. The initial balance was calculated as 1760840 conventional units. units, speed 2207280 arb. units, final balance 1887166 conventional units. units As a result, a turnover sheet and balance sheet were compiled.

Accounting and reporting and the use of accounting registers for small businesses" recommend special simplified accounting registers for accounting in a small enterprise. Statements for accounting in a small enterprise: No. B-1 "Statement of accounting of fixed assets, accrued depreciation charges ( wear)" – is...