Most enterprises and organizations have buildings and structures on their balance sheet. This important part of fixed assets must be maintained in working order and repaired periodically and on time. How exactly depreciation of buildings is calculated, what the features are in various production situations, is discussed below. In this article we will look at what constitutes building depreciation.

The need to calculate depreciation of buildings

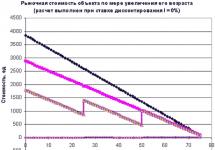

Buildings, as part of the assets of the enterprise, are used to support the production process and for administrative (management) purposes. Over the years, they gradually wear out, which is natural. Buildings lose their original properties and characteristics. As the technical condition deteriorates, their value decreases. When property is first entered into accounting records, it has an initial value. It is initially determined by the purchase price and the costs of putting it into operation.

Depreciation in accounting: basics

The starting element in the methodology for calculating depreciation is the useful life (LPI) of real estate assets. It is installed following the data of the “Classification of fixed assets included in depreciation groups.” It operates in accordance with government decree in 2002. It is also necessary to take into account the changes made on 07/07/2016. Their action began in January of this year.

The SPI is the period during which the building is able to serve productively as an asset and contribute to the accomplishment of the taxpayer's objectives.

The enterprise determines it itself, based on the date the building was put into operation and information about the OS classification: (click to expand)

| OS groups (buildings incl.) | SPI (years) | |

| over | up to (inclusive) | |

| 4th | 5 | 7 |

| 5th | 7 | 10 |

| 7th | 15 | 20 |

| 8th | 20 | 25 |

| 9th | 25 | 30 |

| 10th | 30 | |

How is depreciation of buildings calculated in accounting?

To determine the amount of depreciation, an enterprise has the right to use the following methods:

- Linear.

- Reducing balance.

- Write-offs based on the sum of SPI years.

- Write-offs based on the physical volume of products.

At =(1/k)*100% ,

k – months of useful operation of the building.

Example No. 1. At the beginning of 2016, the organization purchased a building (warehouse) with an initial cost of 18 million rubles. SPI - twenty years.

Every year you need to depreciate 1/20 of the cost of the premises.

Depreciation:

- Norm:

- per year 1/20 · 100 = 5%,

- monthly (1/(20*12))*100%=0.041667%,

- Sum:

- for the year 18,000,000 · 0.05 = 900 thousand rubles.

- per month 900/12 = 75 thousand rubles.

For 20 years, you should make monthly entries:

Dt 20 Kt 02 75 000 depreciation of the building has been accrued.

Important! The linear method is most appropriate to use, since for buildings the determining factor influencing their service life is time, and not obsolescence.

Reducing balance method

The basis for determining annual depreciation is: (click to expand)

- residual value of buildings as of the first day of the year;

- rate (percentage) of depreciation;

- acceleration factor.

This coefficient increases the rate by 1.8-3 times, which allows you to accumulate the amount of wear much faster. But its use is limited to the legally established list, which includes objects used in high-tech industries.

The method allows you to write off a significant amount of wear and tear already in the first few years of operation of the building. This makes it possible to recover the costs of its acquisition with maximum efficiency.

Important! When the residual value of buildings reaches 20% of the original value, the balance should be fixed. In the future, to determine depreciation (monthly), it must be divided by the number of months before the expiration of the SPI.

Method of writing off value over the sum of SPI years

The basis is the initial cost of buildings and the summation of the number of years of their service.

Example No. 2. The cost of the acquired building is 3.5 million rubles. SPI – seven years.

The calculation is:

∑ numbers of seven years 1+2+3+4+5+6+7 = 28

Depreciation is calculated in the amount (for individual years of operation):

I 7/28 = 25% 3.5 0.25 = 875 thousand.

II 6/28 = 21.43% 3.5 0.2143 = 750

III 5/28 = 17.85% 3.5 0.1785 = 625

IV 4/28 = 14.29% 3.5 0.1429 = 500

V 3/28 = 10.71% 3.5 0.1071 = 375

VI 2/28 = 7.14% 3.5 0.0714 = 250

VII 1/28 = 3.57% 3.5 0.0357 = 125

Over a period of seven years, the building is fully depreciated.

Proportional to the physical volume of production

When calculating depreciation (A), the following data is used:

- the volume of products planned for production in the reporting period, in physical terms;

- the ratio of the initial (Ps) cost of the building and the quantity of products (Op) for the entire SPI.

The following formula is used:

This method effectively calculates the depreciation of an active composite asset. Deductions are made in each reporting period (monthly) regardless of what results the company has achieved during this time. When the SPI ends, no depreciation should be charged.

Important! The company makes an independent choice of how it will calculate depreciation, and be sure to note this in its accounting policies.

Building depreciation: wiring

The account used for depreciation is 02. Accounting entries reflecting the transactions:

Calculation of depreciation of buildings in tax accounting

Tax legislation provides two ways to calculate depreciation of buildings:

- Linear – depreciation is calculated evenly and separately for each object. Regardless of the accounting policy of the organization, it must be applied to buildings. The basis for the calculation is their initial cost.

- Nonlinear.

The linear method is described above (example No. 1).

When applying the nonlinear method:

- The amount of depreciation should be calculated for the complex of buildings, and not for each one separately.

- The basis is taken as the residual value of the OS, not the original one. Their total assessment is reduced monthly by the accrued amount of depreciation.

Depreciation charges (A) are determined as follows:

A = Co Na, where:

Co – residual value of the building complex;

Na is the depreciation rate.

The size of the latter is:

| Depreciation group | Norm, % |

| 4 | 3,80 |

| 5 | 2,70 |

| 7 | 1,30 |

| 8 | 1,00 |

| 9 | 0,80 |

| 10 | 0,70 |

Example No. 2. The total residual value of buildings of the seventh group is 15 million rubles on the first day of the year. For the 7th group of fixed assets, the depreciation rate is 1.3%.

Let's calculate the amount of depreciation:

- January 15,000,000 · 1.3/100 = 195 thousand rubles.

- February (15,000,000 – 195,0000) 1.3/100 = 14,805,000 1.3/100 = 192,465

- March (14,805 – 192,465) 1.3/100 = 14,612,535 1.3/100 = 189,963

The residual value of the group of buildings at the beginning of the second quarter will be:

14,612,535 – 189,963 = 14,422,572 rubles.

Further calculations are carried out in exactly the same way.

In a non-linear way, the cost of buildings is written off much faster than in a linear way. The amount will be 35-40% in the first year of asset operation.

Important! The method is convenient to use in organizations that prefer accelerated depreciation.

Features of depreciation calculations for reactivated and reconstructed buildings

When buildings are mothballed for a period exceeding three months, depreciation is paused. After the object is put back into production, it begins to be calculated again in the manner prescribed by the enterprise. The peculiarity is that it is necessary to increase the SPI of the building for the period it is in conservation - months or years.

Depreciation of residential and non-residential buildings

The cost of non-residential buildings used by entrepreneurs in business is repaid through depreciation using any of the methods described above. For residential buildings, depreciation is calculated according to current depreciation standards. This calculation occurs at the end of the year. The movement of accrued depreciation amounts is reflected in account 010 (off-balance sheet).

Depreciation of buildings during liquidation

In case of liquidation of fixed assets, they should be written off from the balance sheet. The operation should be formalized by order of the manager and a Certificate of the appropriate form. In tax accounting, costs associated with liquidation, including underaccrued depreciation, are included in non-operating expenses. The following entries will be used in accounting:

| Debit | Credit | Write-off transactions |

| 01.2 | 01 | initial cost of disposed buildings |

| 02 | 01.2 | depreciation |

| 91.2 | 01.2 | residual value of buildings |

| 91.2 | 60 | Reflection of expenses for liquidation of OS |

Calculation of depreciation under the simplified tax system, UTII and unified agricultural tax: features

Simplification does not mean that depreciation charges can also be abolished. If operating systems are present and used in the business process, it means that they are worn out and, someday, will require replacement or repair. The amount of depreciation under the simplified tax system “income minus expenses” is included in total costs and reduces the tax base.

In tax accounting, the cost of fixed assets must be repaid evenly, in equal parts over one calendar year. The simplified tax system “income” involves paying tax on the amount of income received. Depreciation is not included in it, so such entrepreneurs may not charge it.

A similar situation exists for enterprises with UTII, where the object of taxation is imputed income. But such organizations keep accounting in full. And depreciation is calculated according to general rules, most often in a straight-line manner. This also applies to the Unified Agricultural Tax.

Top 5 Frequently Asked Questions

Question No. 1. The building has been under renovation for 10 months. Is it necessary to calculate depreciation?

Answer. Depreciation should be suspended if the repair period exceeds one year. Until this period, it is calculated in accordance with the procedure established by the enterprise.

Question No. 2. The individual entrepreneur owns a building with a mortgage. Is it subject to depreciation? IP on OSNO.

Answer. Depreciation is charged. But it can only be taken into account for tax purposes if the building is used for business.

Question No. 3. An organization bought non-residential premises in order to place an office in it. It occupies the first floor of a multi-storey residential building. Is there a depreciation group to which it should be classified?

Answer. Residential buildings last more than 30 years, so the premises that are part of them should be classified as group ten.

Question No. 4. How to determine the depreciation period of a building in tax accounting?

Answer. It is necessary to establish its SPI using the official OS Classification (Government Decree 31 of 2002 plus amendments).

Question No. 5. SPI should be defined as:

- Any provided for by the corresponding depreciation group.

- Maximum for the same group?

Answer. Any useful life of buildings is selected, corresponding to the time interval provided for the group of fixed assets to which they need to be classified.

Buildings belong to the passive part of the OS. For their timely restoration and continuation of SPI, it is important that the enterprise, by analyzing its benefits, independently determines which depreciation methods are appropriate for it to use.

How the useful life of buildings and structures is determined. How to calculate depreciation rates for buildings and structures?

Accounting standards for depreciation of buildings and structures

The procedure for determining depreciation rates for buildings and structures in accounting depends on the depreciation method used.

Let us present the formulas by which the monthly depreciation rate (N M) is determined for a specific building or structure for various methods of its calculation (clause 19 of PBU 6/01):

Linear method:

N M = 1 / SPI / 12where SPI is the useful life (SPI) of a building or structure in years.

The monthly amount of depreciation with this method is found by multiplying the rate N M by the initial (replacement) cost of the building or structure for which the rate was calculated.

Declining balance method:

N M = K / SPI / 12where K is the increasing coefficient established by the organization (not higher than 3).

With this method, the monthly depreciation amount is determined by multiplying the N M rate by the residual value of the building or structure at the beginning of the year for which depreciation is calculated.

Method of writing off cost by the sum of numbers of years of useful life:

N M = CL / ∑CHL / 12where CHL is the number of years remaining until the end of the useful life of the building or structure, calculated at the beginning of the year for which depreciation is calculated;

∑ЧЛ - the sum of the numbers of years of the useful life of such a building or structure.

The monthly depreciation amount is found as the product of the N M rate by the initial or replacement cost of a specific building or structure for which the N M rate was calculated.

Depending on the method chosen in accounting for calculating depreciation for a group of homogeneous fixed assets, depreciation of buildings and structures using the above methods will be calculated based on the given standards.

Let us also recall that with the depreciation method proportional to the volume of production (work), neither the annual nor the monthly depreciation rate is calculated.

Tax standards for depreciation of buildings and structures

We talked about what depreciation methods can be used in tax accounting in ours.

Using the linear method in tax accounting, the monthly depreciation rate (N M) is found as follows (clause 2 of Article 259.1 of the Tax Code of the Russian Federation):

N M = 1 / SPI Mwhere SPI M is the useful life of the building or structure expressed in months.

The monthly depreciation amount using the linear method is found by multiplying the original (replacement) cost of the fixed asset by the depreciation rate.

We talked about what the monthly depreciation rate is when using the nonlinear method, as well as about the features of calculating depreciation using this method.

The average annual cost of fixed assets is 150 million rubles. , including: buildings - 30 million rubles. (depreciation rate 8 rubles, including: buildings - 30 million rubles (depreciation rate 8%); equipment - 25 million rubles (10%); computers - 10 million rubles (15%); transport - 67 million rubles (14%); other - 12 million rubles (12%). The cost of products produced during the year is 412 million rubles. Determine the annual amount of depreciation calculated using the straight-line method and capital productivity.

buildings - 30 million rubles. (depreciation rate 8%);=2.4 equipment - 25 million rubles. (10%);=2.5 computers - 10 million rubles. (15%);=1.5 transport - 67 million rubles. (14%);=9.38 others - 12 million rubles. (12%). = 1.44 Total: annual depreciation: 2.4 + 2.5 + 1.5 + 9.38 + 1.44 = 17.22 (Residual value of fixed assets is 144.0-17.22 = 126.78 million rubles. Capital productivity is equal to: 412.0: 126.78 = 3.250 (rounded) 3.250 - this is the capital productivity ratio)

Stanislav's calculation - completely. true. Depreciation - 172200000t. R. Capital productivity. = 3.249 Only the amount of fixed assets turned out to be not 150.0... but -144 million rubles.

Find the depreciation rate Given: the cost of buildings is 500 thousand rubles, the service life is 150 years.

and more equipment: cost 200 thousand, and service life 50 years. Thank you in advance!

Yulka, why are you being tortured with such terrible tasks!!! We were told in passing how to calculate this, but I don’t remember (((

Who knows the depreciation rates for a new building? Hello. Please write down the depreciation rate for an industrial (commercial) building if it was not purchased new. How many years can it be depreciated after purchase? Does the period of use of the building before me affect the current norm?

The procedure for calculating depreciation for a purchased building that was already in use from another organization. The organization has the right to determine the depreciation rate for this property independently, taking into account the requirements of paragraph 7 of Article 258 of the Tax Code and the Classification of Fixed Assets. In other words, the useful life can be determined as established by the previous owner, reduced by the number of months of operation. If the period of actual use of the acquired object from the previous owners turns out to be equal to its useful life in the Classification of fixed assets, then the organization has the right to independently determine the useful life of this fixed asset, taking into account safety requirements and other factors. The initial cost of second-hand fixed assets acquired by an organization is determined in the same way as the initial cost of new fixed assets. This amount should include all costs associated with the purchase: contract price, transportation costs, etc.

You must determine the lifespan of the building yourself. You will write off depreciation from your cost at what you bought it for, and not what the supplier had. Therefore, you set your service life, calculate the depreciation rate and set the method for writing off depreciation.

The depreciation rate for the building is 2%. What is the standard service life of this building?

they've been pissing for years.

The building's depreciation rate is 2%. What is the standard service life of this building? 1) 50 years 2) 100 years 3) impossible to calculate

50 years is the standard. In fact, it is impossible to calculate.

Ilona, this is a question for idiots... Is there really no knowledge and brains to answer even such a primitive question? What are you doing at the university then?

How to calculate the monthly depreciation rate? The building is stone two-story:

Book value RUB 90,000,000.

Depreciation rate code 10 002

Depreciation amount (annual) 1.20%

Depreciation rate (annual) 1.20%

And how much will the depreciation be in rubles?

Multiply the book value by the depreciation rate and divide by 12 months

Depreciation is used in connection with the need to keep objects accounted for while at the same time attributing their value to expenses. For fixed assets that have a significant price and a long service life, this operation is also necessary to write off their cost gradually, which helps reduce costs. The depreciation of buildings has a number of specific points that you need to know in order to avoid miscalculations and not fall under the supervision of regulatory authorities.

The most important parameters and principles of correct calculation of depreciation for buildings

It is believed that the ratio of accumulated depreciation charges on a building to its cost is an indicator of the degree of its depreciation, but in practice this is not always true. The amount of depreciation is rather a normative and purely mathematical value. Depreciation charges for a building will only comply with legally established standards when the following parameters necessary for calculation are correctly determined:

- The final cost of the property, which consists not only of the costs of purchase or construction and related operations, but also increased during completion or revaluation;

- Useful life (hereinafter - SPI) of the object;

- The amount of previously accrued depreciation on the building when it was accepted from the owner who previously operated it;

- The method of calculating depreciation, depending on the legal form and the taxation system used by the organization.

Additional parameters affecting depreciation charges for a building are:

- Reconstruction and modernization increase the SPI of the object, the additional value of which is determined by the enterprise independently;

- Preservation from three months and major repairs from a year increase the SPI of a building for a similar period. No depreciation is charged during this period.

To ensure that accounting depreciation amounts do not cause unnecessary problems with inspection authorities, information on the specified additional parameters must be entered into the inventory card.

Determination of useful life

To calculate depreciation on a building, you need to determine the standard SPI, for which you need to use two documents:

- Decree of the Government of the Russian Federation No. 1 of 01/01/2002 for buildings included in depreciation groups from the fourth to the ninth inclusive. In each group you can find different buildings, based on the structural characteristics given in the resolution. The SPI of an object can be determined within the range approved for the corresponding depreciation group;

- To establish the SPI of buildings of the tenth depreciation group, you must refer to the still relevant Resolution of the USSR Council of Ministers No. 1072 of October 22, 1990, since there is no more detailed information in Resolution No. 1, except for indicating that the SPI is more than 30 years. By dividing the number “100” by the uniform rate of depreciation for the building approved by the document, you can establish the SPI of the object in years.

Of the coefficients of Resolution N 1072, it is necessary to use only those determined for buildings in the amount of 3.3 to 0.4 percent, which will correspond to the SPI in the range from 30 years 4 months to 250 years (364 - 3000 months). Coefficients above these values correspond to objects deciphered in Resolution No. 1 of 01/01/2002 in groups four to nine.

Automation of an accountant's workplace, having simplified accounting, often leads to the fact that, having completely trusted the program, a person does not notice errors that arose as a result of typos when entering balances or other actions of incompetent employees. Therefore, checking the established SPI for buildings and correcting incorrectly determined depreciation parameters of buildings before the regulatory authority reveals this will never interfere with the work.

Choosing a method for calculating depreciation on buildings

With the help of specialized accounting programs, depreciation on buildings is easily calculated. It is enough to enter all the necessary data into the electronic card of the fixed asset so that the application program accurately performs the required operations.

However, in order to avoid mistakes, it is necessary not only to know how to calculate the depreciation of a building without using software, but also to confidently navigate when choosing depreciation parameters.

The choice of each of the four methods for calculating depreciation on buildings, approved by PBU 6/01, is available to enterprises and individuals using the simplified tax system, since with the simplified tax system, the requirements of Article 259 of the Tax Code of the Russian Federation predetermine only two methods:

- Linear- the most common and simplest. The uniform amount of monthly depreciation is found by multiplying the cost of the object by the depreciation rate, measured as a percentage. The norm is determined by dividing the number “100” by the object’s SPI in months. Only this method is required to be applied by taxpayer organizations to buildings of depreciation groups 8, 9 and 10;

- Nonlinear- more profitable, since the calculation confirms the possibility of deducting higher amounts, but It cannot be used for accounting purposes . Therefore, having chosen it, the accountant needs to apply two methods to one building, which is not very convenient.

Buildings should begin to be depreciated the next month after they are taken into account, regardless of their commissioning.

Features of budget accounting for depreciation

Public sector institutions, by Order of the Ministry of Finance N 157n dated December 1, 2010, are limited in the choice of depreciation parameters such as the accrual method and SPI. Methods for calculating depreciation:

- Depreciation deductions in the amount of 100% are made for objects worth up to 40 thousand rubles inclusive when registering immovable buildings and when putting them into operation movable;

- For all property worth over 40 thousand rubles, the linear method is used.

When determining SPI, unlike others, public sector employees must choose the longest period from the range defined for the depreciation group.

Fixed assets are a means of labor that participates repeatedly and for a long time in the process of productivity, retain their natural form and gradually, as they wear out, transfer their value to the cost of the finished product. Production fixed assets operate in the sphere of material production.

The initial cost of fixed assets is the sum of the costs of manufacturing or purchasing a processing plant, transportation and installation.

Depreciation is monetary compensation for the depreciation of fixed assets by including part of their cost, the cost of production. The amount of depreciation depends on the cost of fixed assets, their operating time and modernization costs.

The ratio of the annual amount of depreciation to the cost of fixed assets expressed as a percentage is called the depreciation rate. The depreciation rate shows what share of its original cost is transferred annually to the means of labor for the products it creates. The general depreciation rate consists of a rate for major repairs and a rate for renovation.

Calculation of cost and depreciation of buildings and structures

The cost of buildings and their depreciation rates are taken for a factory similar to the one being designed and the data is summarized in a table. The depreciation rate for buildings ranges from 1 to 5%.

Table 4 - Calculation of depreciation of buildings and structures

|

Name |

Estimated cost, rub. |

Depreciation |

|

|

Amount, rub. |

|||

|

Dewatering area | |||

Building volume

The estimated cost is determined by multiplying the volume of the building by the cost of construction of 1 cubic meter

We find the depreciation of the building by multiplying the depreciation rate by the estimated cost of the building and dividing by 100%.

Calculation of cost and depreciation of technological equipment

Based on the designed technological diagram, accepted performance and circuit diagram of the devices, it is determined

name, type and quantity of equipment required for installation.

The costs of transportation and installation of equipment are 25% of the cost of the equipment. The cost of unaccounted for and small equipment is assumed to be 10% of the cost of major equipment. The cost of spare parts is 3% of the cost of capital equipment. Equipment costs are calculated in the table.

Table 5 - Calculation of equipment costs and depreciation

|

Name |

Quantity, pcs. |

thousand roubles. |

Transportation costs and installation, thousand roubles. |

Initial cost, thousand roubles. |

Depreciation |

|||||

|

Amount.thousand rub. |

||||||||||

|

Main production equipment: | ||||||||||

|

Mill MSHR | ||||||||||

|

Belt Conveyor | ||||||||||

|

Mill MMS | ||||||||||

|

Hydrocyclone | ||||||||||

|

Unaccounted for equipment | ||||||||||

|

Spare parts | ||||||||||